Artificial intelligence This is already a reality for many companies and industries, although its development is currently in its infancy, and as such, it is a technology with immense potential to change the world, much like the advent and development of the Internet. So at the turn of the century. It is true that not everyone will be a winner, as was the case with the development of the Internet, and knowing who will be on the path and who will lead in this first step is not an easy task. and reach the end. Therefore, to participate in the long-term potential of AI, it is best to do so in a diversified manner.

Today we propose to introduce the potential of AI into our portfolios through an ETF specializing in this sector and a distributed bet among 37 companies specializing in this new technology. about this Wisdom Tree Artificial Intelligence. The UCITS ETF USD Acc, (ISIN IE00BDVPNG13), is listed on several markets (ticker/RIC on Xetra: WTI2.DE). This represents an exchange-traded fund index Nasdaq CTA Artificial Intelligence, purchasing all elements of the index, i.e. with complete replication. The companies in this index’s eligible universe are classified into three groups based on each company’s role in the artificial intelligence („AI”) value chain and its estimated exposure to the sector:

- Boosters: Companies that represent a significant force in the AI field, but the product or service in question does not currently represent a fundamental part of their revenue.

- Facilitators: Companies that play a major role in the AI space and some of their key products or services are helping the continuous advancement of AI.

- Developers– Companies primarily focused on providing AI-based products and services.

Within each group, each company is assigned an AI intensity score based on the following factors:

- The estimated portion of the company’s revenue attributable to AI products and services.

- How important AI is to the company’s product offering and its positioning.

- The importance of a company’s AI solutions in the market.

Companies with the highest AI intensity score in each group are then selected for inclusion. The total weighting of the groups is set at 10% for developers, 40% for facilitators and 50% for developers. Finally, individual firms in each group are balanced. Included stocks are filtered according to ESG criteria.

Set the rate of a cumulative ETF Hence it reinvests the dividend in the fund itself. Assets under management amount to €522 million and its NAV at the time of this report is €46.73. It was launched on November 30, 2018 and is based in Ireland and managed by Vistatree. It is an ETF that complies with UCITS and MIFIT II norms and has a European passport. The fund’s currency is USD, however we recommend buying the ETF on Xetra, which is quoted in Euros, so we avoid currency risk and exchange rate costs.

Regarding expenses, note that the Total Expenses (TER) of WisdomTree Artificial Intelligence. UCITS ETF USD Ac is 0.40%.

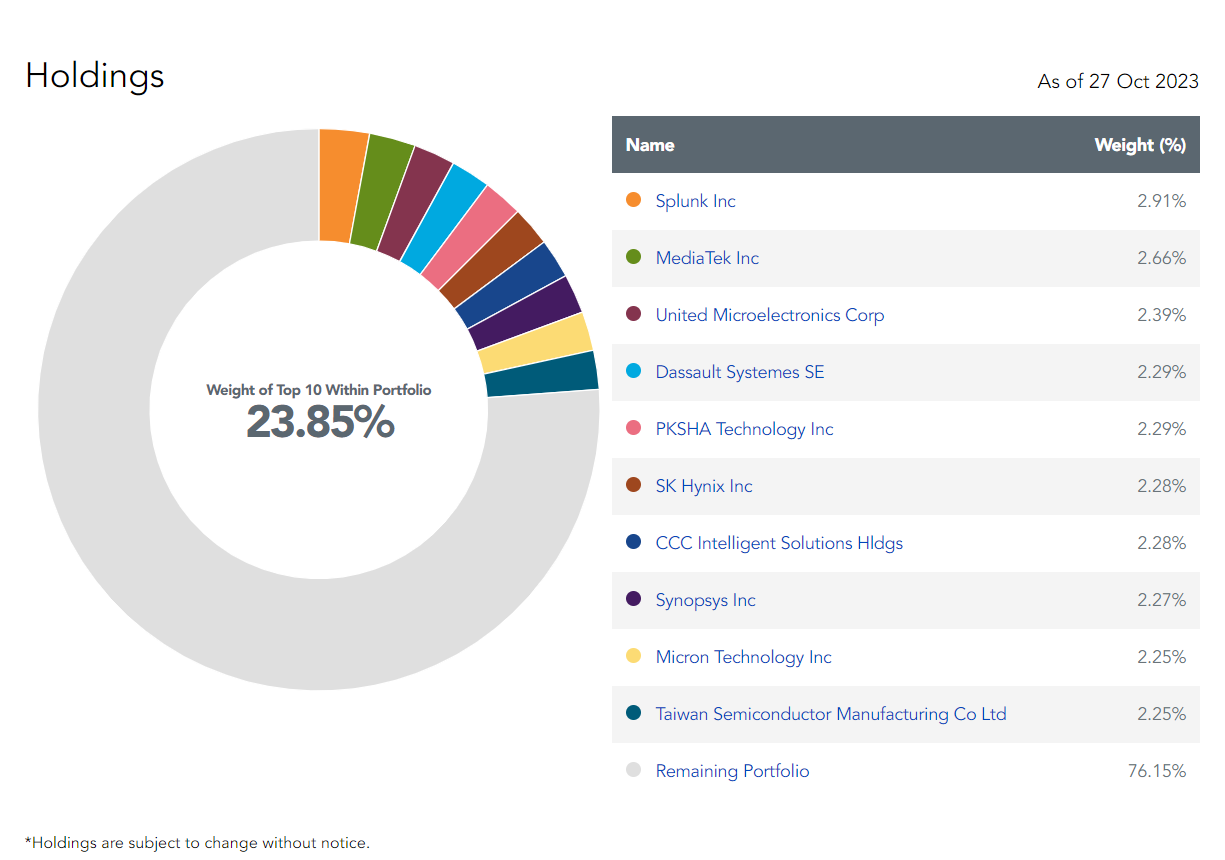

The structure of ETFs consists of 37 companiesHowever 6% of the total weight is contributed by the Fantastic 7: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

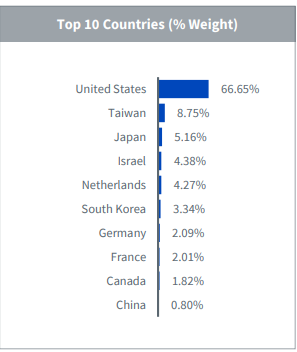

In terms of geography, 65.66% of companies are based in the United States9.52% from Taiwan, 5.11% from Japan, 5 from South Korea, 4.08% from the Netherlands, 2.47% from the Cayman Islands, 2.29% from France, 2.05% from Germany and other countries (Israel, Canada, Jersey and the United Kingdom). Less than 2%.

Danger:

On a scale of maximum 7, this ETF has a risk level of 5 and is geared towards long-term investment (around 5 years).

The volatility is 24.67% in 1 year and 25.46% in 3 years. The maximum drawdown is -16% in 1 year, and -39.76% in 3 years. Maximum loss since inception, -39.76%. Among relative risk ratios, observation error, which measures the volatility of a fund’s deviation from its benchmark, is 5% in 1 year and 4.35% in 3 years, moderate levels; Beta, the volatility of the fund with respect to its benchmark index is 1.18 in 1 year and 1.16 in 3 years.

Profitability, (Remember that past profitability does not guarantee future profitability):

YTD return +24.33%, 1 year +14.83% and 3 years +21.92%. Since inception, the maximum gain is +110.33%.

Profit vs. Danger:

In absolute rates, the Sharpe ratio represents the additional profit for every 1% risk in the form of volatility, which is 0.25 in 1 year and 0.05 in 3 years; Sortino relates the ETF’s return to the risk-free return and indicates an additional return of 0.22 over 1 year and 0.04 over 3 years for every 1% volatility.

Therefore, the investment recommendation is to participate in a diversified manner with the potential of artificial intelligence and a long-term investment horizon.

You are interested

If you want to learn how to invest and manage your assets, Investment Strategies has created an online course so you can learn how to invest for the short, medium and long term with us. Online course to learn how to invest in stock market and mutual funds With a commitment of 15 minutes a day, you will learn to apply fundamental analysis, technical analysis, macroeconomic analysis or operations with mutual funds and ETFs to your investors.

Any investor can be trained in one of our global investment courses. More info here