At COP28 in Dubai, banks such as Goldman Sachs, Citigroup, JPMorgan Chase and Barclays are gearing up to boost carbon offset deals. They aim to help companies buy carbon sequestration projects, trade credits and offsets.

The move supports smaller projects in emerging markets that lack financial backing. Citi's Sonia Batik highlights the struggle of many developers to secure finance, emphasizing the role banks like Citi play in bridging the funding gap in carbon markets.

Rushing into the trillion-dollar carbon market

The rush reflects a market approaching $1 trillion, enabling companies to achieve net zero without completely reducing emissions. However, the market faces controversy, with some credits receiving criticism for not meeting environmental claims.

The head of South Pole, the world's biggest seller of carbon offsets, has resigned amid allegations of greenbacks, prompting a revaluation. Understanding equilibrium momentum and market terms will be critical to Wall Street's success in this emerging Voluntary Carbon Market (VCM).

By 2022, climate commitments from major banks including Citi, JP Morgan, Barclays and HSBC have reached $5 trillion.

Last month, the World Bank It announced plans to establish a mechanism to certify forest carbon credits in the coming months. Their aim is to revolutionize banking operations while increasing reliability and transparency of VCMs.

Canada's largest bank, RBC Global Carbon Market backed the company with $8 million to grow its platform.

According to the CEO of Carbon Growth Partners, along with growing demand, there will be an undersupply of high-quality credits.

Bankers warn against allowing criticism to undermine confidence in the future of carbon offsets, stressing the need to avoid financing these projects.

Goldman Sachs sees fragmented markets that lack efficiency and transparency. They are focused on expanding trade across sustainable commodities, including carbon and renewables. JPMorgan has invested significantly in carbon trading, hiring its first voluntary credit trader this year and expanding its carbon capabilities.

However, global banks' liquidity is raising concerns in the unregulated market. Michael Sherren warns of the shortcomings of voluntary forest carbon schemes, warning against relying solely on offsets for net zero emissions.

Despite criticism, offsets play an important role in addressing residual emissions in challenging sectors.

Voluntary Carbon Standards at COP28

Achieving the 1.5C global warming target requires substantial carbon reductions and VCM plays a large role.

During the first week of COP28, key voluntary carbon standard setters pledged to align best practices and improve transparency.

United States of America Commodities Futures Trading Commission (CFTC) High-integrity carbon offsets reveal standards for future trading. UN officials in Dubai are expected to unveil new safeguards around VCM based on experts' draft rules last month.

In the closing stages of COP28, observers await the finalization of rules for the United Nations-regulated carbon market under Article 6 of the Paris Climate Agreement.

Carbon price falls to record low – 12% Demand declined last year and is expected to decline by 5% in 2023. Still, the drivers of demand persist.

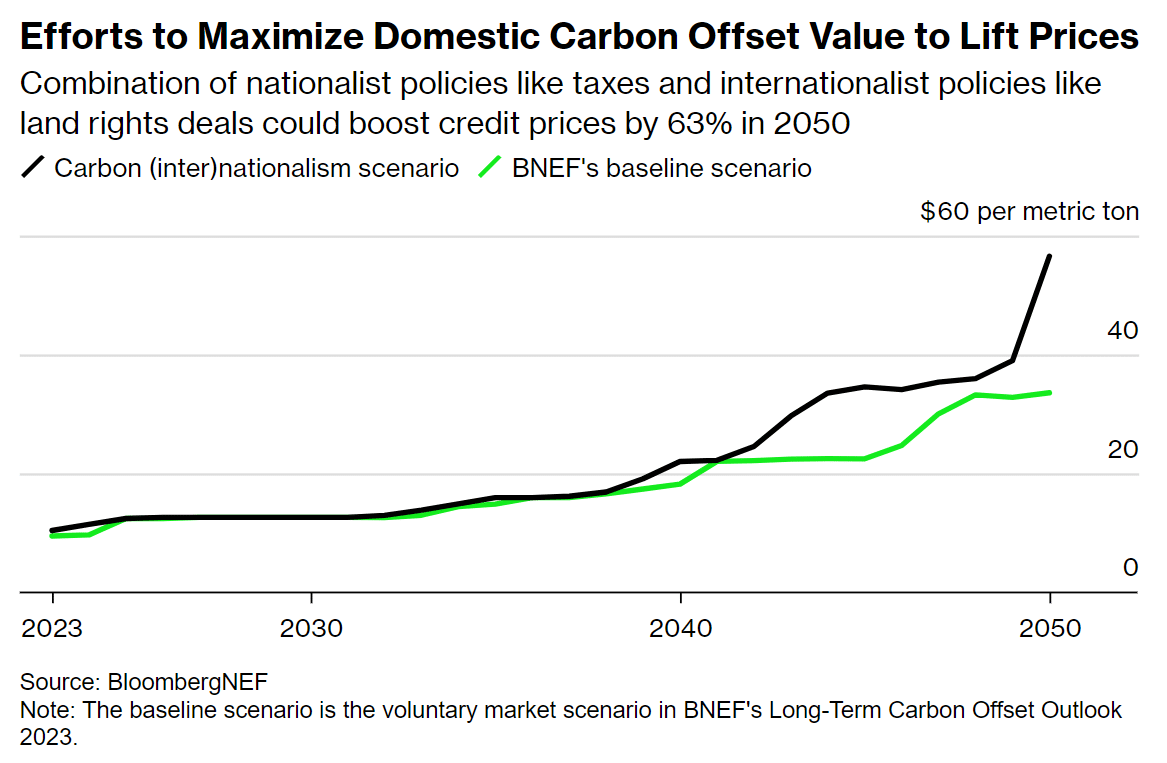

Factors include companies relying on offsets to meet net zero goals and potential national regulations. According to research by BNEF, these set the stage for significant price increases by mid-century.

In a statement Environmental marketAverage prices of VCM credits hit their highest point in 15 years.

While the volume of voluntary carbon credits fell by 51%, the average credit price rose significantly 82%from $4.04 per ton in 2021 to $7.37 in 2022It has not been seen since 2008.

Bank green and financial net zero

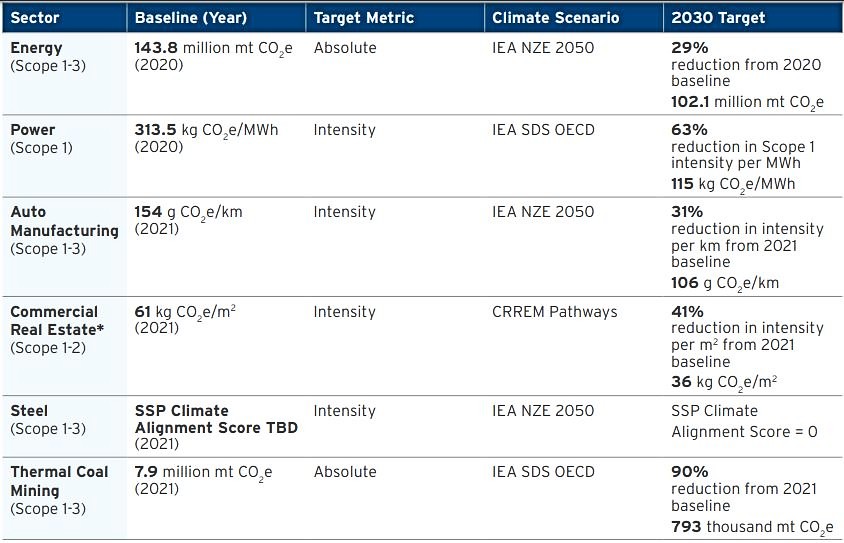

Citi's Carbon Markets team consists of four London-based traders and four sellers focused on the voluntary carbon market. The bank has an ambitious goal of achieving net zero emissions for operations by 2030 using carbon credits. Commit to achieving net zero financing by 2050, with the following sectoral emission reduction targets.

City 2030 emission reduction targets

Barclays recently brought in an industry expert to lead its carbon trading operations.

The future of the carbon offset market is subject to uncertainty, particularly regarding technological advances that could transform carbon removal efforts. But this potential innovation introduces a „venture capital-style risk,” said one City executive.

He stressed that established prices and mechanisms for carbon credits are ideal, but cautioned against using them for emerging technologies. However, he highlighted Citi's intention to actively engage in removals once scaled up.

The banking industry stands out in its ability to help companies transition to a low-carbon economy by financing sustainable projects. If the banks' funds were channeled into efforts to reduce emissions, it would help scale carbon markets faster toward net zero.

. „Gracz. Namiętny pionier w mediach społecznościowych. Wielokrotnie nagradzany miłośnik muzyki. Rozrabiacz”.