Get free equity updates

We will send it to you myFT Daily Digest Email rounding up is recent Shares News every morning.

U.S. stocks posted their biggest weekly gain since mid-June in a five-day period full of economic data that ended with jobs data suggesting the economy may be on track for a „soft landing” despite interest rate hikes.

The S&P 500 rose 0.2 percent on Friday, taking its weekly advance to 2.5 percent. The tech-heavy Nasdaq composite ended fractionally lower, gaining 3.2 percent in five sessions.

The moves followed the release of the August non-farm payrolls report, which contained several data points shaping investors’ outlook on the domestic economy and interest rates, but suggested a possible „Goldilocks” scenario in which inflation comes under control without triggering a recession.

The U.S. economy added 187,000 jobs last month, the Bureau of Labor Statistics reported Friday. That was higher than the 170,000 expected by economists polled by Reuters, but payrolls for June and July were revised down by 110,000.

The jobless rate rose to an 18-month low of 3.8 percent, ahead of economists’ forecasts that it would hold steady at 3.5 percent.

Meanwhile, average hourly earnings rose 0.2 percent from July, the slowest pace since February, but up 4.3 percent on a year-over-year basis. Wage growth should be a major contributor to inflation, encouraging policymakers to have monthly increases.

„It’s a Goldilocks kind of report where you have enough of a slowdown for the Federal Reserve, but it doesn’t look like consumers are going to be affected much by getting those wage increases,” said senior investor Rob Haworth. Strategist at US Bank Wealth Management.

U.S. government bond yields fell to their lowest level in three weeks immediately after the jobs data, but were higher in the afternoon session. The yield on the policy-sensitive two-year Treasury rose 0.02 percentage points to 4.88 percent, while the 10-year Treasury rose 0.09 percentage points to 4.18 percent. Yields rise when prices fall.

Haworth said „August is a complicated seasonally-adjusted month” because of the start of the US school year payrolls figures. But last month’s figures may have been affected by unusual events, such as strikes in Hollywood and layoffs of about 30,000 workers at the Yellow Trucking Group.

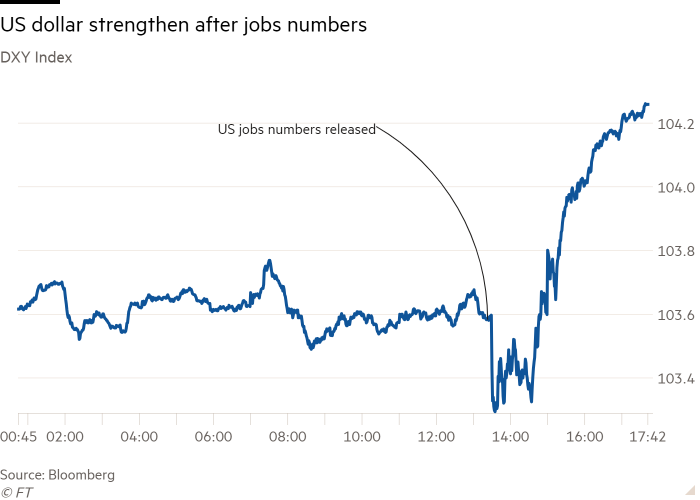

The dollar index, a measure of the currency’s strength against a basket of six peers, rose 0.6 percent.

Some of the earlier session’s market optimism was related to subdued elements of the jobs report suggesting the U.S. Federal Reserve may avoid further interest rate hikes this year, and then St. The Cleveland Fed said inflation was „very high.”

The state of the US labor market has worried investors and economists in recent months as the world’s largest economy continued to add jobs and report higher wages despite the central bank’s aggressive monetary tightening campaign.

Other figures this week pointed to signs of a slowing labor market, with job openings falling to a more than two-year low in July. But Thursday’s personal consumption expenditure report helped buoy investor confidence on a soft landing in the economy, with inflation rising as expected in July and consumers increasing their spending.

Futures markets are pricing in a 93 percent chance the central bank will leave rates unchanged when it meets later this month.

„A soft landing scenario is not ruled out [Friday’s] job report,” said Florian Ielpo, Head of Macro at Lombard Odier Asset Managers. „It strikes a good balance between good and bad news.”

Elsewhere, Europe’s Stoxx 600 index was flat, while Germany’s Dax fell 0.7 percent. It comes a day after eurozone core inflation, which excludes volatile energy and food prices and is closely watched by the European Central Bank, fell to 5.3 percent in August from 5.5 percent in July.

London’s FTSE 100 rose 0.3 percent, led by energy and basic materials groups including BP, Shell and Glencore.

In Asia, meanwhile, China’s CSI 300 rose 0.7 percent after an unexpected increase in Chinese manufacturing activity last month.

In commodity markets, Brent crude, the international benchmark, rose 2 percent to settle at $88.55 a barrel.

„Oddany rozwiązywacz problemów. Przyjazny hipsterom praktykant bekonu. Miłośnik kawy. Nieuleczalny introwertyk. Student.