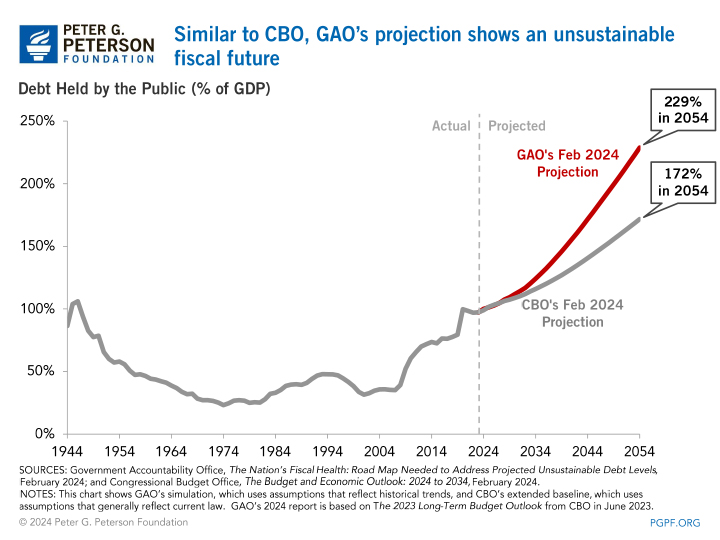

Government Accountability Office (GAOs) Latest Report Analysis from the Nation's Fiscal Health Echo Congressional Budget Office (CBO) warned that The federal debt is on an unsustainable path. The report outlines the drivers of the nation's fiscal trajectory and calls on Congress to create a plan to address that outlook.

According to the GAO's projections, public debt will double over the next 30 years—rising from about 97 percent of gross domestic product (GDP) at the end of fiscal 2023 to 229 percent in 2054. Those projections assume current policies. It involves some simplifying assumptions about the relationships of various budget types with the size of the economy over the next decade and over the next two decades.

Although GAO's projections are based on CBO's estimates released last year, their findings are A recent report from the CBO Focuses on structural factors that cause disparity between costs and revenues:

- Growth at cost. The GAO's report highlights that future federal spending will be driven by increases in health care programs, Social Security and net interest. Each of those spending categories is projected to grow faster than the economy over the next 30 years. By 2052, the GAO estimates, federal spending on health and social care will be 13.9 percent of GDP, up from 10.6 percent in 2023. Much of that increase is related to an aging population and rapidly rising health care costs. Net interest will grow significantly over the long term, reaching historic highs of 3.2 percent of GDP in 2030 and 7.9 percent of GDP in 2052—making the debt burden the largest “project” in the federal budget over the next 30 years. And higher interest rates.

- Insufficient revenue. For projections through 2033, GAO adjusts CBO's baseline values to assume that expiring current tax rules will be extended, reducing revenue for federal treasuries and widening the deficit. Individual income tax provisions that were part of the Tax Cuts and Jobs Act (TCJA) also expire at the end of 2025. With those assumptions, GAO found that revenue would average 17.0 percent over the 2024-2033 period. In 2034 of GDP, the GAO makes a simplifying assumption that revenue will remain constant at 17.4 percent of GDP through 2097, their 50-year historical average.

In the report, GAO reiterates its sense that Congress must develop an effective funding plan to address the unsustainable fiscal path, including four pieces of legislation introduced in Congress in 2023 or 2024 to create a bipartisan fiscal commission. An Effective Plan to Address the Funding Path: GAO believes that:

- Create financial rules and goals to manage debt.

- Consider alternative approaches to the current credit limit.

- Evaluate all drivers of debt.

- Address funding gaps in Social Security and Medicare.

- Pursue other opportunities to promote fiscal responsibility through good government initiatives.

GAO's findings add to the unbiased evidence and analysis that shows action is needed to improve our fiscal outlook so the nation can meet future challenges, invest in the next generation, and build a strong and inclusive economy.

RELATED: 8 Surprising Facts About the US Fiscal Outlook

Image credit: www.gao.gov

„Oddany rozwiązywacz problemów. Przyjazny hipsterom praktykant bekonu. Miłośnik kawy. Nieuleczalny introwertyk. Student.