Read this article in English.

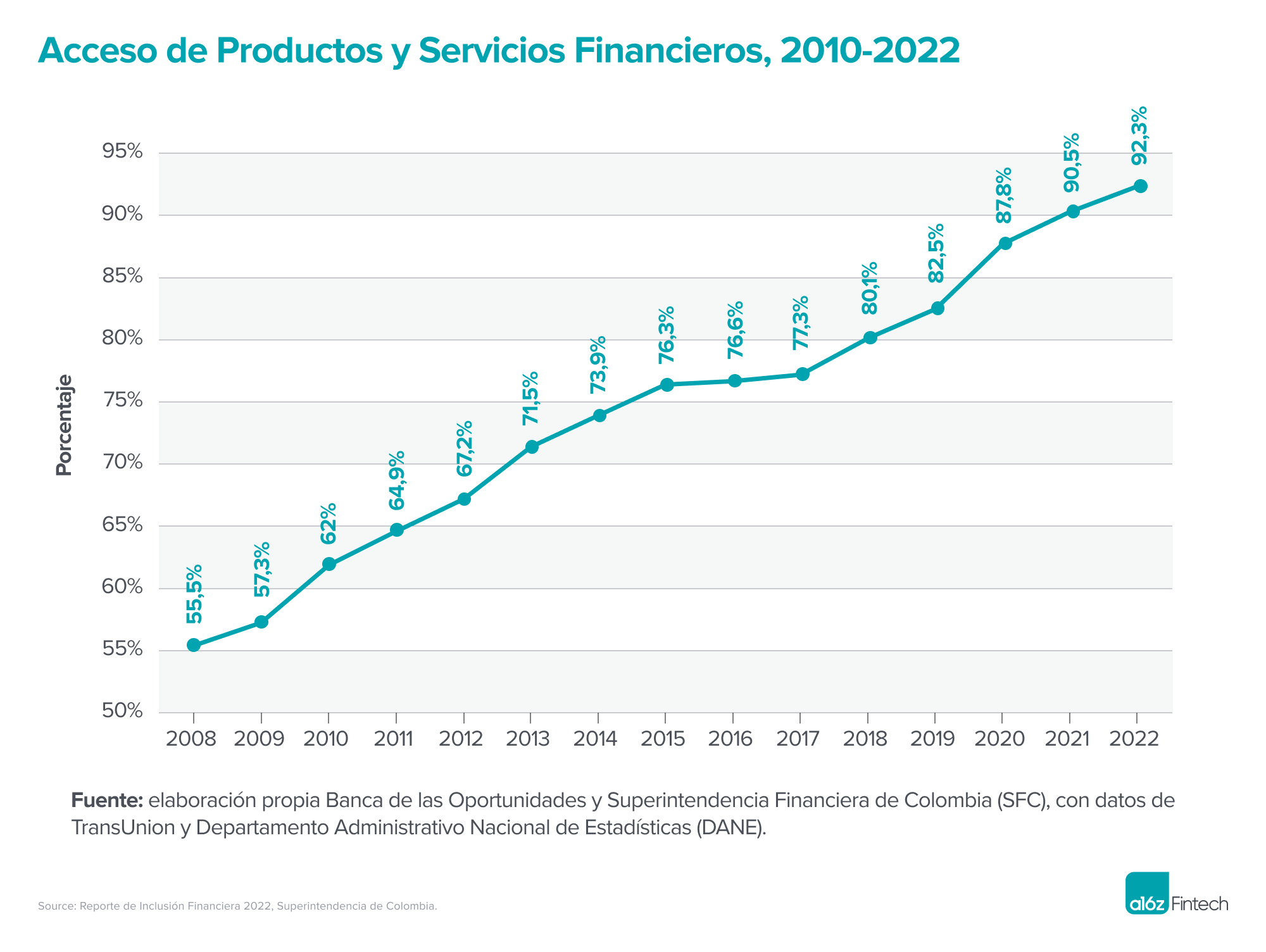

Historically, Colombia’s financial sector was one Also regulated of the world. However, in the last decade, the country has occupied Third place Latin America is the largest fintech hub (after Brazil and Mexico), with nearly 300 fintech companies. According to a report by Ernst & Young, The Seventy six percent of Colombians use fintech services, the highest fintech adoption rate in Latin America. Additionally, the percentage of Colombian adults who own a banking product, from 2008 to 2022 officer 55% to 90%.

Because Most With Colombians now having access to a smartphone, the Internet and a basic bank account, conditions are ripe for accelerating financial innovation and inclusion. That trend is reinforced by advances in licensing and open finance, the promise of global instant payments, and regulatory support for innovative fintech solutions.

In particular, several government measures have increased fintech capabilities in Colombia in recent years.

De novo licenses Promote market competition

For years, obtaining a de novo banking license in Colombia was difficult and expensive. Lucha Historical efforts by the government to suppress drug trafficking and money laundering. Currently, Colombia’s banking sector is highly concentrated: they are the only ones 29 fully licensed banks According to the International Monetary Fund, (credit institutions) and the three largest banking conglomerates control more than 60% of deposits.

However, a few years ago, Colombia’s financial watchdog, the local regulator, opened up the market by introducing what is known as the financial institution license. This license has lighter capital and regulatory requirements, but allows the holder to raise deposits through savings or electronic deposit accounts, make loans backed by these deposits, and issue cards.

Since then, fintech companies including Robi, Ula, Bolt, Mercado Paco and Nubank have been approved to offer deposit, transaction and loan accounts. This not only allows the new operators to offer a broader set of financial products (capturing the entire economy leading to sustainable business models), but also gives Colombian consumers greater confidence that they can trust the new operators with their money.

An open banking system expands access and inclusion

Not only is the government opening up the market to new operators, but so is the government Confident To create a solid structure Open Financecontinuously Example of Brazil. Last year, the government added Open Fund to it National Development Plan, a basic law establishing an economic development plan for the next four years. If fully implemented, it will allow Colombians to own and access their banking data regardless of the bank they bank with. In addition, the government has shown itself open to the possibility of full bank account portability, allowing people to move account information between banks, similar to their cell phone numbers, when changing institutions.

Instant and interoperable payments will accelerate digitization

After BIG’s success in Brazil, the Colombian government has promised to start Your own version An instant, operable and free payment system over the next two years. Recently, the governor of the central bank (regulator of payments) indicated that he will announce the technology partner by October this year and he expects the system to be operational by the end of 2024. Most interbank payments still involve significant costs (up to USD 2 per payment), which will drive the digitization of payments in the country.

The future of fintech in Colombia

In Colombia, fintech is expanding its reach: the industry is estimated to be growing around a 120 % A year on, and the number of fintech companies in the country has grown More than double In the last five years.

Through recent government actions, Colombia is moving towards a more open and transparent financial system, in which a large number of fintech companies compete to earn users’ trust, money and business based on the quality of their products and services. The new watchdog has reaffirmed the government’s commitment to an inclusive agenda that encourages competition and innovation. Now it’s up to founders and entrepreneurs to seize the moment by continuing to create products that drive the future of banking and finance in Colombia.