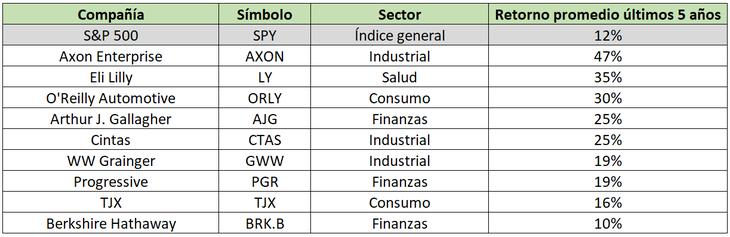

Less than 2% S&P 500 It has been consistently successful for the past 5 years. And the returns are very impressive.

There are some stocks that don’t fall. Actually, only 9 S&P 500 Has positive annual returns since 2018. which ones Let’s see:

1 – Axon Enterprise: A company that develops weapons technology and products for the military, police and civilians. Its initial product was Taser, a line of electroshock weapons.

2 – Eli Lilly: It is a pharmaceutical company that focuses on developing drugs to treat diseases such as diabetes, cancer and rheumatoid arthritis. It is one of the 15 largest corporations in the United States.

3 – O’Reilly Automotive: A chain of auto parts and auto parts retail stores. The company has more than 5,600 stores in the United States.

4 – Arthur J. Gallagher: Global insurance brokerage, risk management services and consulting. The company is headquartered in Illinois and has more than 43,000 employees.

5 – Tapes: A company dedicated to the manufacturing and distribution of occupational safety related uniforms, facilities and services, it is one of the largest in the industry.

6 – WW Granger: is a company dedicated to the sale of industrial and commercial products such as tools, lighting, electrical products and chemicals. It serves more than three million customers worldwide.

7 – Progressive: An insurance company that focuses on cars, homes and businesses. It is the largest in the United States.

8 – TJX: TJMaxx is a retail chain that operates stores such as Marshalls, HomeGoods and Sierra Trading Post. The company is based in Massachusetts.

9 – Berkshire Hathaway: GEICO is a holding company that owns majority interests in several subsidiaries, including Duracell, Dairy Queen and Fruit of the Loom. The company is run by Warren Buffett.

To know more about this topic and general content about investments, you can visit our website. Financial letter.

The overall market (as measured by the S&P 500) has fallen in 2 of the last 5 years. Throughout 2019, 2020 and 2021, the S&P 500 rose. But it fell by 6% in 2018 and experienced one of its worst declines (-19%) in 2022. That’s why it’s notable that these stocks haven’t suffered particularly in negative years.

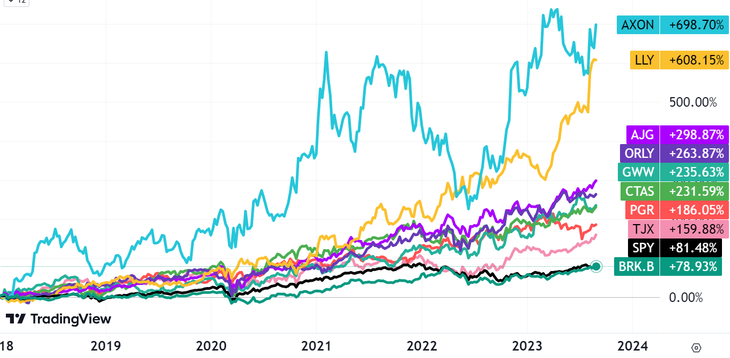

Here’s a look at these stocks’ cumulative returns since 2018 compared to the S&P 500 (black line):

Berkshire Hathaway is the only stock on the list that hasn’t outperformed the S&P 500 in returns. Warren Buffett. However, it is unfair to analyze performance alone without taking into account the perceived risk.

A better way to analyze it is through the beta coefficient, which measures the riskiness of a security relative to the market in which it operates. And Berkshire Hathaway has a beta of less than one. It has less volatility than the market (S&P 500) and is therefore considered less risky.

¿Will these 9 companies continue their successful journey? Hard to say, but they certainly have good fundamentals and track records.

Use: The content of this note should not under any circumstances constitute investment advice or a recommendation to buy or sell any particular asset. This content is for educational purposes only and reflects the opinion of the author only. In all cases it is advisable to consult a professional before investing.

CEO of Garda Financiera