For years, it was not the economy that determined voting behavior in Turkey. The country's president, Recep Tayyip Erdogan, has won nearly every election he has contested despite a worsening economic outlook.

It is generally explained The importance of identity politics In a country polarized by policies during Erdogan's ruling Justice and Development (AK) Party's 22-year rule.

However, Erdogan's streak came to an end on Sunday, March 31, following Turkey's local elections. His AK Party lost the popular vote for the first time since 2002 and is the main opposition group won In major cities including Istanbul and Ankara.

The reason this time is different is that the huge accumulated costs of years of policy mistakes are now beginning to bite in earnest.

So, what was the economic outlook as the country went to the polls?

On March 21, the Central Bank of Turkey Raised interest rates Unexpectedly 50%. The move is the latest in a Successive rise in rate This follows Erdogan's re-election as president in May 2023. This was seen as evidence of the central bank's commitment to fight runaway inflation. Close to 70%.

The rising interest rates were widely hailed as a much-needed shift away from a long history of unconventional monetary policy. Erdoğan's unorthodox policy stance arose from him Deep faith Raising interest rates will reduce inflation rather than increase it.

The pandemic and Russia's invasion of Ukraine fueled inflation worldwide. While almost every central bank raised interest rates in response, Turkey embarked on a rate cut. Keeping rates artificially low has contributed to a rise in domestic inflation, and has made Turkey an inflation champion alongside Argentina and Venezuela.

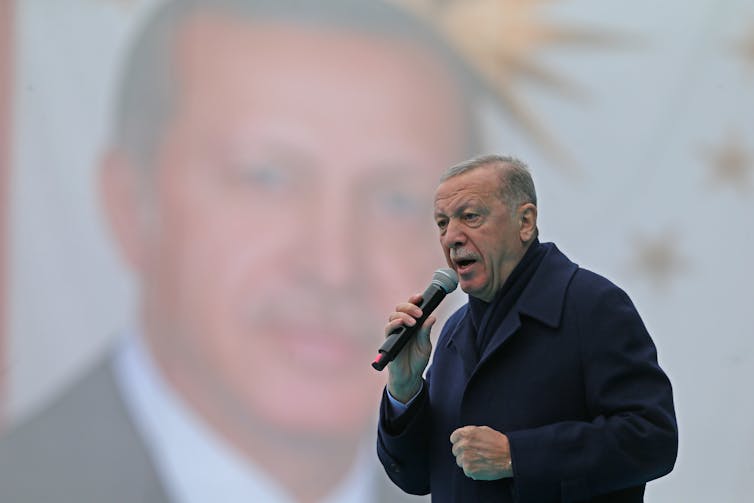

Necati Savas/EPA

Disconnection from other emerging economies

There were emerging markets Amazingly resilient In the face of the global financial crisis. Unlike in the past, many emerging economies have been able to avoid large fluctuations in their exchange rates, avoid debt distress, and keep inflation under control.

One reason for this is the success of emerging economies Improving their policy framework, particularly by improving the independence of their central banks. More specifically, there are central banks in these countries Significantly improved Their communication and transparency are also very good at predicting inflation. Thus, countries including Chile, the Czech Republic and South Africa outperformed their peers in advanced economies.

Unfortunately, Turkey was an outlier in this field. The country has completely abandoned the independence of its central bank and the independence of its monetary policy Six different governors In the last five years.

Politics also plays a disproportionate role in shaping economic policy. changes The Turkish constitution, which came into force in 2018, has given Erdogan substantial executive powers. Very generous cost Ahead of the 2023 presidential election.

The minimum wage rose significantly and expensive pension schemes and subsidized housing schemes were implemented. This expansion of public spending naturally contributed to inflationary pressures that were already building.

Turkey's position as an outsider to loose monetary policy has cut rates between 2021 and 2023, when everyone else was tightening, due to its central bank now having to raise rates while others begin an easing cycle.

Why is this important?

Monetary policy is wrong for most countries. But it is especially important for countries like Turkey that are more open to trade and financial flows, and where exchange rate movements are a major source of fluctuations in the domestic economy.

One of the biggest losers in Erdogan's unorthodox monetary policy is the Turkish lira. Over the past six years, the lira has appreciated fell dramatically against the US dollar. In January 2018, you would have to part with 3.76 liras to buy one US dollar. Today, this number is 31.9 lire.

Large fluctuations in the value of the lira for the Turkish economy for several reasons.

First, a significant portion of Turkey's imports inputs Used in the manufacturing process, especially in the manufacture of vehicles, machinery and mechanical equipment Almost half Exports of the country. Any fall in the value of the lira will increase input costs and prices. Reduces competitiveness Exports of the country.

Second, Turkey imports a significant portion of its energy from abroad. In much the same way, any depreciation of the lira would make importing energy more expensive.

Third, sits Turkey Substantial external responsibilities In foreign currency terms. This makes the depreciation of the lira even more expensive. A loss in its value magnifies the amount of resources required to repay a given level of foreign currency liabilities.

hikrcn/Shutterstock

Advancing

And Turkey's return to orthodox economic policy is good news. But this is too late, and there are also sharp reversals in policy Not enough To turn the tide in its economy, especially in the fight against inflation. Persistent inflationary pressures have forced citizens to to increase their assets foreign currency, which has put further pressure on the lira.

Faced with a slowdown in foreign capital inflows, the authorities had to Burns significantly Foreign currency reserves to prevent the lira from falling further. The sharp increase in interest rates on March 21 should similarly be seen as the price the country has to pay for its past policy mistakes.

More importantly, it has been almost a year since Turkey returned to a more conventional economic policy and there is no plan to restructure the economy with formal institutional reform at its core. If you need proof that strong and independent policy institutions benefit economic performance, you need look no further than the recent downturn in other emerging economies.

Brazil, for example, did not recover strongly from the pandemic. It has been overcome Control inflation And a pride Best performing coins In this world.

„Oddany rozwiązywacz problemów. Przyjazny hipsterom praktykant bekonu. Miłośnik kawy. Nieuleczalny introwertyk. Student.