-

There is no dry powder in the US economy as inflation eats away at household savings.

-

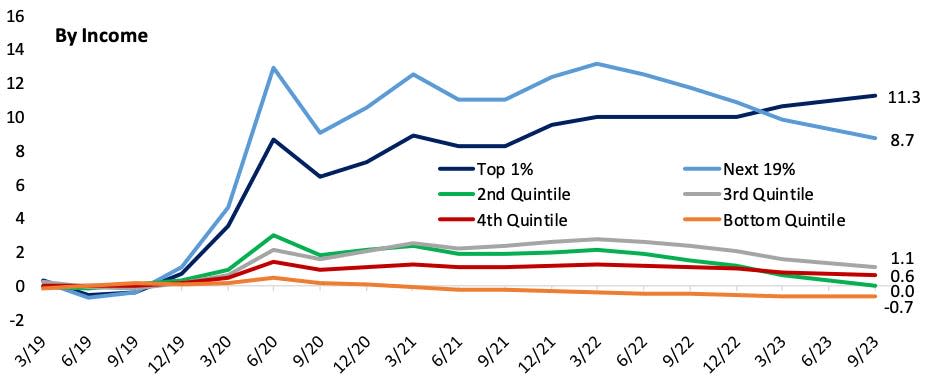

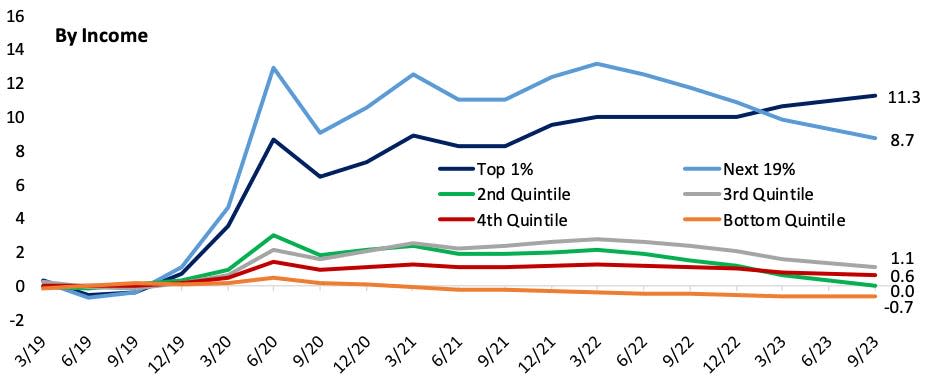

Cash savings as a percentage of total consumption has returned to 2019 levels for most Americans.

-

Consumer spending could begin to pull back, pushing the economy into recession, experts warn.

According to an analysis by Bespoke, inflation has practically wiped out the excess savings of American households, running out of cash savings that were expected to boost the economy.

Consumers built up „huge cash reserves” during the pandemic, partly due to a slowdown in spending and government-issued stimulus checks. That money was seen as a buffer against the slowing U.S. economy, giving consumers some way to spend despite tight financial conditions.

But those expectations are actually misplaced, the investment firm said in a note, as inflation has eaten away at the spending power of most Americans' household savings.

Although households have nominally more savings than before the pandemic, that picture changes when we look at cash savings as a percentage of total consumption, putting additional pressure on consumers from rising prices.

When calculating money market and deposit assets as a percentage of total consumption, most Americans have about the same amount of savings as they did in 2019.

Money market + deposit assets, % of total consumption, change from 2019 average (%)

„For all but the highest-income and very wealthiest households … cash balances relative to consumption have returned to where they were in 2019. In other words, there is no cash powder to finance consumption growth,” the agency said. „This is especially true given the fact that the elite and wealthiest consumers do not have the monetary constraints to consume in the first place.”

Consumers are flashing other signs that their financial health is starting to deteriorate. Credit card debt hit new highs last year. Meanwhile, student loan payments have resumed after a gap of three years, viz Many people find it difficult to keep up with the bills while maintaining a strong pace of spending.

Slower spending could spell trouble for the U.S. economy, which still faces a decent risk of a recession in 2024. A pullback in spending could lead to a consumer-led recessionMacquarie strategists said in a November note.

Read the original article Business Insider

„Oddany rozwiązywacz problemów. Przyjazny hipsterom praktykant bekonu. Miłośnik kawy. Nieuleczalny introwertyk. Student.