U.S. stocks advanced on Friday, with the S&P 500 index posting its biggest one-day gain since April as traders cheered after the latest jobs report and passage of the debt ceiling bill in the Senate.

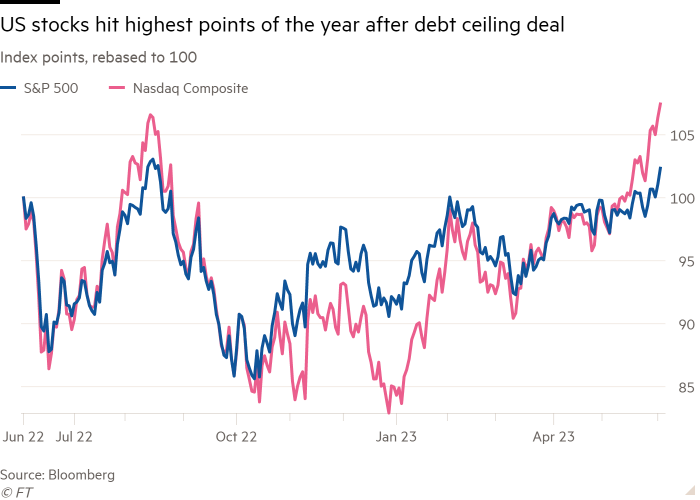

The Wall Street benchmark S&P 500 rose 1.5 percent to its highest level since August, marking its third straight week of gains with a 1.8 percent gain.

The tech-heavy Nasdaq Composite added 1.1 percent to levels last reached in April 2022. Its weekly increase of 2 percent brought the index its sixth consecutive week of gains.

Cboe’s Vix index, a measure of stock market volatility often referred to as Wall Street’s „fear gauge,” fell to 14.60, its lowest level since February 2020.

Investors opened the day after the U.S. Senate on Thursday approved a deal between the White House and congressional Republicans to raise the debt ceiling for two years in exchange for cuts in government spending.

The deal ended a week-long political standoff that has sparked unprecedented debt default risks in the world’s largest economy.

Stocks were further buoyed by U.S. Labor Department data showing nonfarm payrolls rose 339,000 in May, beating the 190,000 consensus estimate of economists polled by Reuters, an unexpected sign of labor market strength. The unemployment rate rose to 3.7 percent from 3.4 percent in April and wage growth slowed to 4.3 percent on a year-over-year basis.

„While employment growth was surprisingly strong, other data from the establishment painted a more complicated picture of the labor market,” Bank of America analysts wrote. „While average hourly earnings are not the best measure of wage growth, the trend suggests easing wage inflationary pressures from a year ago.”

However, the headlines indicate a slowdown in the US economy, making it more likely that the Federal Reserve will continue to raise interest rates in an effort to reduce inflation.

Markets gave a 29 percent chance of an interest rate hike in June, up from 25 percent on Thursday, according to Refinitiv. Prices have priced in the possibility of a quarter-point increase by July.

„Today’s numbers will add fuel to the fire that the Federal Reserve needs to raise rates again, despite appearing poised to pause hikes earlier this year,” said Marcus Brooks, chief investment officer at Quilter. Investors.

The US two-year Treasury, more sensitive to monetary policy expectations, rose 0.16 percentage points to 4.50 percent after the jobs report. The 10-year yield rose 0.07 per cent to 3.70 per cent. As prices fall, bond yields also rise.

The moving dollar added 0.5 percent against a basket of six peer currencies as investors awaited higher rates.

The pan-European Stoxx 600 rose 1.5 percent, while London’s FTSE 100 added 1.6 percent. France’s Cake 40 rose 1.9 percent.

London-listed Dechra shares rose 7.6 per cent after the veterinary drug firm agreed to a £4.5bn buyout by Sweden’s EQT, one of the biggest UK private equity deals of the year.

Asian markets rallied. Hong Kong’s Hang Seng index rose 4 percent to lead the region as internet and technology stocks bounced back.

Shares listed on China’s CSI 300 index Shanghai and Shenzhen rose 1.4 percent. South Korea’s KOSPI rose 1.3 percent and Japan’s TOPICS rose 1.6 percent.

West Texas Intermediate, the U.S. West Texas Intermediate, rose 2.1 percent to trade at $71.56 a barrel, while Brent crude, the international benchmark, rose 2.3 percent to $75.98.

„Oddany rozwiązywacz problemów. Przyjazny hipsterom praktykant bekonu. Miłośnik kawy. Nieuleczalny introwertyk. Student.