ams OSRAM has decided to review its strategy related to microLED technology after the basic plan for the development of this project was unexpectedly cancelled.

This has been officially announced by the company No further information was given about what the project would have been and the actors involved. “Conversations are ongoing with the relevant customer,” it elaborates. The same.

In all of this, ams OSRAM after an unexpected interruption to this important microLED project It sees the need to reassess the future allocation of its resources and assets linked to this technology line, particularly highlighting the role of its latest 8-inch LED plant located in Coolim.Malaysia.

Based on this turn of events and a preliminary analysis, the Company anticipates the need to apply adjustments for non-financial depreciation affecting both assets and goodwill directly related to microLED technology. Estimates at the start of the financial year range from 600 to 900 million euros 2024. Thus, changes in the capitalization of R&D investments in microLED and the reduction of subsidies from public funding programs will affect the operating profit (adjusted EBIT) for the fiscal year 2024 by about 30 to 50 million euros. Further, the cancellation of the plan is expected to improve the company's cash flow profile over the next 24 months, inter alia by reducing capex or capital expenditure.

What is OSRAM's commitment to microLEDs?

The company's microLED strategy focused primarily on the company's existing facilities in Malaysia.

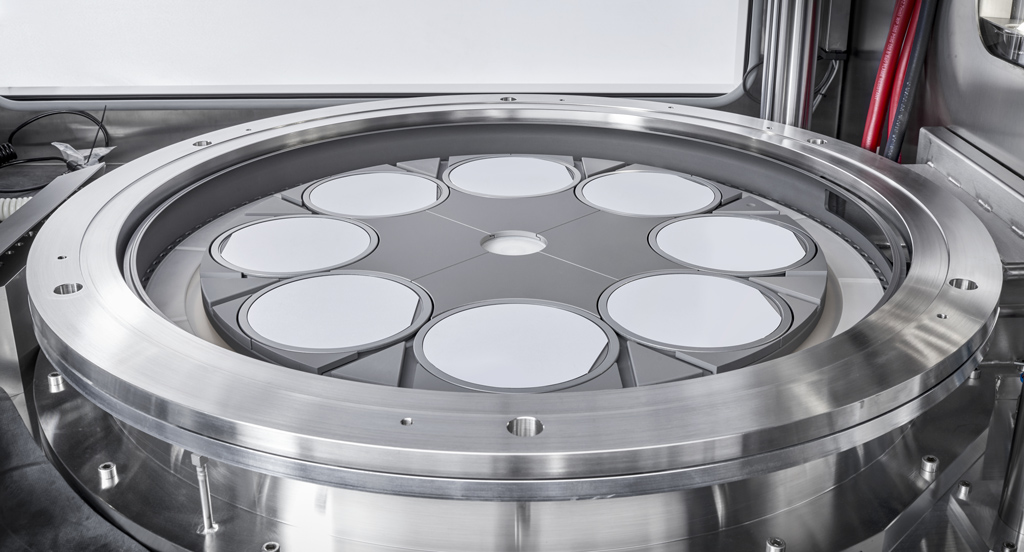

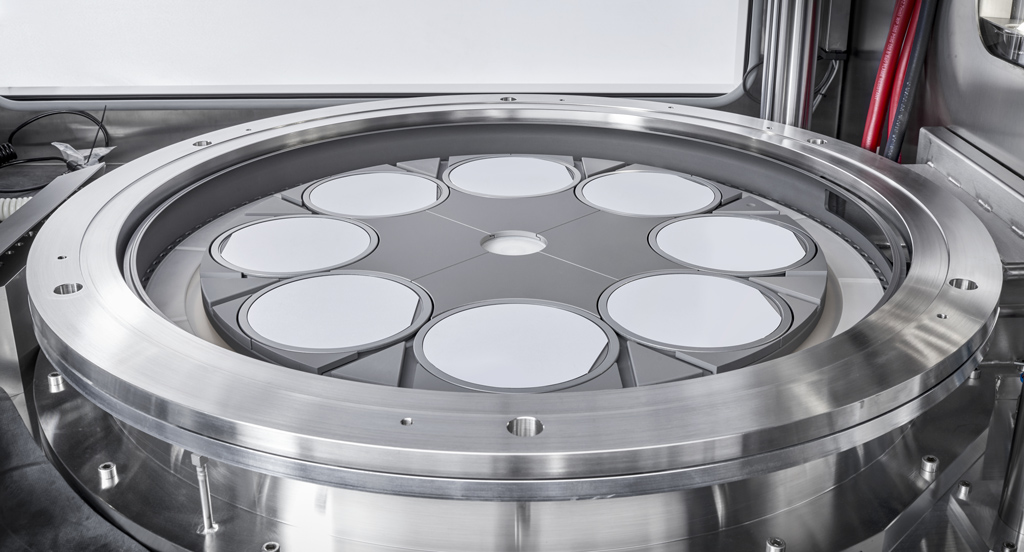

In the spring of 2022, ams OSRAM announced plans to expand 200mm wafer production capacity at its Malaysian factory. For future LED and microLED production. Additionally, In February 2023, qualification of MOCVD deposition systems on 200 mm wafers was announced, Aixtron SE, a global supplier of deposition equipment for the semiconductor industry, aims to produce microLEDs at these facilities.

The MicroLED manufacturing has special requirements: Module manufacturing involves a special transfer process in which several thousand LED chips (arrays) with dimensions measured in micrometers are assembled and transferred. Any defect will result in dead pixels and render the entire array unusable. Therefore, a practically error-free epitaxy process is essential, which minimizes defects and allows high-performance and economically viable production of microLEDs.

That's why the company Opting for Aixtron's experience in its MOCVD deposition solutions, and qualified for MOCVD AIXTRON AIX G5+ C and G10-AsP systems for use on 500mm wafers for microLED applications.

A commitment to Malaysia in manufacturing microLEDs

Last September, ams OSRAM strengthened its commitment to Malaysia through a new cooperation agreement with the Malaysian Investment Development Authority (MIDA).

In 2022, the multinational announced a global investment of around 1 billion euros in production facilities and R&D activities focused on cutting-edge emission technologies for LEDs and microLEDs. This commitment was realized through the construction of its first fully automated 8-inch microLED manufacturing facility in Kulim.

New LED developments in Regensburg

Apart from Malaysia, the company also plans to build microLED production lines at its facilities in Germany. By the end of 2023, ams received positive confirmation of OSRAM's delivery Public funding for the development and research of semiconductor technology at its Regensburg facilities.

Thanks to this, the company expects to invest more 300 million euros To promote research and development of innovative optoelectronic components including microlets.

Its construction The first pilot assembly line for the production of 8″ wafers was underway to begin profitable large-scale production of microLEDs. Very innovative in the very near future.

Without further details, as of now, which project has been cancelled, the commitment to technology ams microLED from OSRAM faces a moment of reflection and strategic restructuring. The year 2023 is marked as YuA breakthrough in the commercialization of microLED technology, giants like Samsung are leading the way with bigger screens and Apple is hitting the ground running with a high-end watch. The transition to 8-inch production lines and the use of vertical chips smaller than 10×10 µm were important advances in the massive development of this technology.

Cover image: Dall-E