Credit: Ned Snowman/Shutterstock

Greenhouse gases released by burning fossil fuels cause the Earth to overheat. It was „the biggest market failure the world has ever seen,” according to economists. Nicholas Stern. The rational behavior of polluting companies by creating profitable products and the desire of most people to drive everywhere produces irrational consequences for everyone: an increase in average global temperature that makes the planet uninhabitable.

But ours Recent research This implies that pollution has a direct financial cost. We used artificial intelligence to link the Standard and Poor’s (S&P). Credit rating formula (capturing borrowers’ ability to repay) with climate-economic models to simulate the effects of climate change on sovereign valuations for 109 countries over the next ten, 30 and 50 years and by the end of the century.

We find that by 2030, 59 countries will see their debt repayment capacity deteriorate and the cost of borrowing will increase as a result of climate change. Our projections for the year 2100 see the number of countries rise to 81.

Financial markets and businesses need reliable information about how climate change translates into material risks. While it is important to design economic instruments and policies that can mitigate the effects of climate change, the field of economics responsible for doing so is relatively young.

New financial products have emerged to help countries and investors better account for climate and environmental disruptions resulting from credit markets, but many problems remain.

Credit ratings or environmental, social and governance (ESG) ratings (assessing how well a company manages these types of risks) are not based on scientific information and are often imposed. Green washing. For example, there are some investment funds that are labeled green according to these ratings Linked to fossil fuel companies.

Financial institutions such as banks often misunderstand models that predict the economic costs of climate change and underestimate the risks. The temperature risesA step Latest Report By actuaries who use mathematics to measure and manage risk and uncertainty.

Their research found a „clear disconnect” between climate scientists, economists, the creators of these economic models and the financial institutions that use them.

In our study, we attempted to integrate climate science into financial indicators that are widely used and understood by investors, such as credit ratings. Without such science-based indicators, financial decision-making can reflect inaccurate and misleading risk calculations. Economic consequences Climate change.

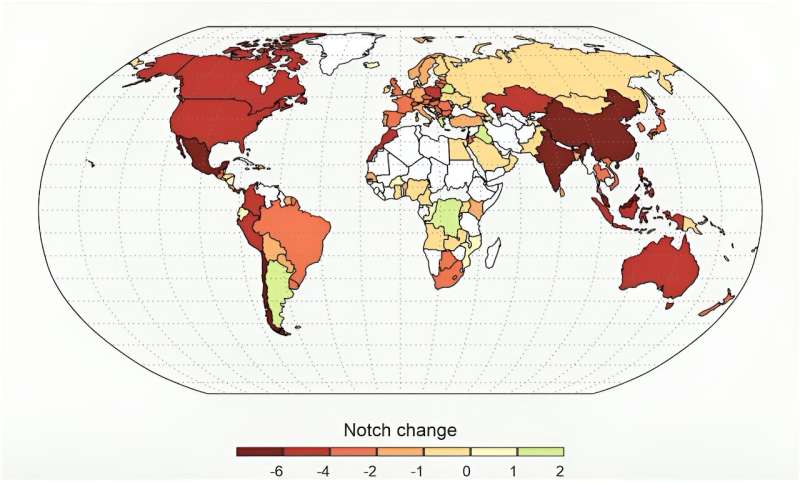

Under high-emission conditions (20-notch scale) the rating decreases. Credit: Patrycja Klusak and Matt Burke

Debt service is rising almost everywhere

Credit ratings reveal a country’s ability and willingness to repay debt and affect the cost of borrowing for countries and other institutions such as banks. Inevitably, these costs are passed on to the public.

When interest rates rise for banks, businesses find it more expensive to finance their operations, thus raising prices for consumers. Higher costs for banks mean higher mortgage interest rates for home borrowers. When banks invest savings, such as pensions, in bonds issued by countries affected by climate disasters, their value is also affected, meaning that the value of pensions may decline.

our Paper Contains three main findings. First, contrary to much of the economic literature, we find that climate change may have material effects on economies and credit ratings as early as 2030.

Credit ratings are classified on a 20-notch ladder scale, with the default lowest rating equaling one notch, and AAA being the highest rating of 20 notches. A higher rating indicates a lower risk of a company defaulting on its loans and vice versa.

Under a high-emissions scenario where recent emissions continue on an upward trajectory, 59 countries will downgrade below one foot in 2030, rising to an average of 81 countries by 2100.

The most affected countries are Canada, Chile, China, India, Malaysia, Mexico, Slovakia and the United States. More importantly, our results show that if the current trajectory of carbon emissions is maintained, almost all countries, rich or poor, hot or cold, will be downgraded.

Second, if countries have honored Paris Agreement And warming of less than 2°C would have little impact on estimates.

Third, we calculated additional costs for countries to service debt (implied as an increase in annual interest payments) of US$45–67 billion (£35–53 billion) under a low emissions scenario and US$135–203 billion under a high emissions one. These translate into additional annual costs of corporate debt, ranging from US$9.9–17.3 billion to US$35–61 billion in each case.

As climate change hits national economies, debt will become harder and more expensive to service. By linking climate science to indicators already embedded in the financial system, we have shown that climate risk can be assessed without compromising the integrity of scientific assessments, the economic validity of modeling, and the timeliness required to develop effective policies.

This article has been republished Conversation Under Creative Commons License. Read on Original article.

Quotation: Climate Change Makes Debt Expensive—New Study (2023, August 18) Retrieved 18 August 2023 from https://phys.org/news/2023-08-climate-debt-expensivenew.html

This document is subject to copyright. No part may be reproduced without written permission except for any fair dealing for personal study or research purposes. Content is provided for informational purposes only.

. „Gracz. Namiętny pionier w mediach społecznościowych. Wielokrotnie nagradzany miłośnik muzyki. Rozrabiacz”.