U.S. stocks fell on Monday as investors awaited news of debt ceiling talks and weighed fresh data pointing to a cooling economy.

The tech-heavy Nasdaq composite rose 0.7 percent, extending its gains from the previous week, while Wall Street’s benchmark S&P 500 added 0.3 percent.

The moves in U.S. stocks came as traders awaited a breakthrough between the White House and Republican lawmakers to raise the federal debt ceiling and avoid a national default ahead of President Joe Biden’s meeting with congressional leaders on Tuesday.

The KBW regional banking index has added 3 percent since March due to the failures of three lenders.

„The stock market has stalled until the debt ceiling resolution is reached and more clarity from the regional banking sector, two factors that are currently weighing on stocks,” said Brad Bernstein, managing director at UBS Wealth Management. to us.

New economic data on Monday added to signs that the Federal Reserve’s aggressive interest rate policy is starting to take effect. The New York Fed’s index of manufacturing activity in the state fell to minus 31.8 from 10.8 in May, well below analysts’ forecasts of minus 3.8. Economists, however, urged caution in interpreting the data, saying it could be influenced by seasonal factors.

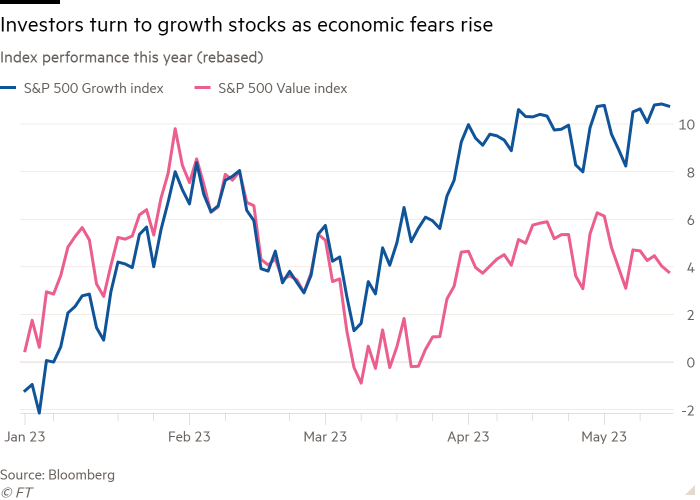

The moves in U.S. stocks continued a pattern of growth stocks outperforming value stocks since the start of the year, as the Nasdaq composite added 19 percent, compared with an 8.1 percent advance for the S&P 500.

„The big established tech names didn’t disappoint in earnings season, and for the most part, provided guidance that was reassuring, something financial markets should be asking for,” said Quincy Krosby, LPL Financial’s chief global strategist.

Traders await Tuesday’s release of U.S. retail sales data for April, which will provide a snapshot of the health of U.S. consumers amid rising inflation and higher borrowing costs.

The dollar fell 0.3 percent against a basket of six other currencies, despite data last week showing U.S. consumer expectations for long-term inflation hit a 12-year high.

In Europe, the regional Stoxx 600 rose 0.2 percent, while France’s CAC 40 and Germany’s Dax ended the day flat after trading flat for most of the session.

European Union statistics agency Eurostat said the European region’s industrial production fell by a better-than-expected 1.4 percent in March, up from 2 percent in the previous month, saying the European Central Bank’s tightening campaign was cooling the region’s economy faster than expected. expected.

„It’s still not enough for the ECB to believe its work is done,” said Mohit Kumar, chief European economist at Jefferies. „They still need to raise more to fight inflation, but economic data suggests they’re not far off.”

Meanwhile, Germany said its wholesale price index recorded its first annual fall since December 2020.

Asian shares rose, with China’s CSI 300 up 1.6 percent and Hong Kong’s Hang Seng index up 1.8 percent. China’s renminbi fell to its weakest level against the dollar in two months on Monday.

„Oddany rozwiązywacz problemów. Przyjazny hipsterom praktykant bekonu. Miłośnik kawy. Nieuleczalny introwertyk. Student.