Production continues to suffer

Article Content

Economists say the Bank of Canada’s view that the worst is behind us has recently been challenged by warning signs from two key sectors of the economy.

Canada may have beaten a recession (so far), but the same cannot be said for the manufacturing sector. Factory sales fell to a two-and-a-half-year low in June, bringing them nearly 6 percent below their peak in May 2023.

Advertising 2

Article Content

Although sales rose in July, the sector is on track for a fourth straight quarter of contraction, said Stephen Brown and Olivia Gross of Capital Economics.

Productive capacity utilization is lower than before the pandemic, “so even as borrowing costs fall further, firms have little incentive to invest,” economists said.

The news echoes the Bank of Canada’s own business survey, which found plans for investment spending below average.

The bank said businesses are increasingly spending money on maintenance and repairs rather than expanding or improving production due to high interest rates, weak demand and economic uncertainty.

Another SA study by the Conference Board of Canada About 63 percent of Canadian businesses are currently operating below their potential.

„Until more businesses reach or exceed optimal capacity, manufacturers will not have a strong incentive to expand their facilities or add to existing machinery and equipment,” it said.

There was more bad news in the construction industry.

Building permits fell 14 percent in June from the previous month, while non-residential permits fell 18 percent to their lowest level since the pandemic.

Article Content

Advertising 3

Article Content

„Commercial, industrial and institutional and government permitting have all declined significantly from their previous post-pandemic peak,” Brown and Gross said.

Both manufacturing and construction declines „will continue to weaken business investment and pose downside risks to the Bank’s GDP forecast,” they said.

According to a recent assessment by Moody’s Analytics, Canada’s „weak” economy remains vulnerable to a number of risks that could plunge it into recession, and there is an increasing risk of a weakening labor market.

If interest rates remain high for an extended period of time, businesses may cut staff, which weakens consumer demand and prompts more layoffs, the report said.

If that’s not enough, the closure of the country’s two national railways this week is costing businesses billions of dollars in losses.

Canadian National Railway Co. and Canadian Pacific Kansas City Ltd. More than 9,000 workers could go on strike or disrupt supply chain operations if a labor agreement is not reached by Thursday.

„The economic impact will be far beyond the $1 billion in freight transported by rail every day,” Goldy Hyder, chief executive of the Business Council of Canada, told Bloomberg.

Advertising 4

Article Content

„This could lead to billions in lost revenue from unsold goods, lost wages to workers unable to do their jobs, and lost contracts from international exporters and consumers.”

Register here Get Posthost delivered straight to your inbox.

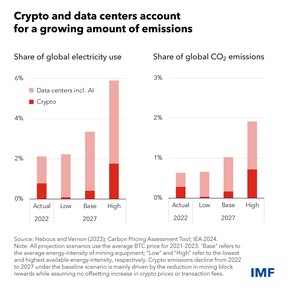

Power-hungry data centers powering AI and cryptocurrency mining now account for two percent of global electricity use and their footprint is growing, according to research by the International Monetary Fund.

To put that number in perspective, generating one bitcoin requires the same amount of electricity that an average person in Ghana or Pakistan uses in three years.

A query to the AI program ChatGPT consumes 10 times the electricity required for a Google search.

The IMF estimates that electricity use by both data centers and crypto mining will rise to 3.5 percent of the global total within three years. That would be about as much as Japan, the world’s fifth-largest user of electricity, now uses.

„The climate impact of these activities – regardless of their social and economic benefits – is of concern,” the IMF said.

Advertising 5

Article Content

Estimates say it will account for 1.2 percent of the world’s total carbon emissions by 2027.

- Canadians get the latest reading on inflation today when Statistics Canada releases the Consumer Price Index for July.

- Revenue: Lowe’s Cos. Inc., Medtronic plc., Keysight Technologies Inc.

Recommended from the editorial

-

Ever wonder why BC gas prices are so high?

-

As recession fears rise, this key risk comes back down to earth

„Real estate is local” is one of the oldest investment adages that emphasizes that markets vary significantly in different geographies and jurisdictions. That’s why it’s important to look behind the headline numbers, says veteran investor David Kaufman. Learn more.

Are you worried about having enough to retire? Need to fix your portfolio? Wondering how to face life? Drop us a line Give us your contact information and the essence of your problem and we’ll try to find some experts to help you while writing a family finance story about it (keeping your name out of it, of course). If you have a simple question, the crack team at FP Answers led by Julie Cassin can give it a shot.

Advertising 6

Article Content

McAllister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McCallister’s Financial Post column helps you navigate a complex field, from the latest trends to financing opportunities you won’t want to miss. And Canada’s lowest national mortgage rates, check out his mortgage rate page, which is updated daily.

Today’s Posthaste is written by Pamela HeavenWith additional reporting by Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, blocked report or suggestion for this newsletter? Send us an email [email protected].

Bookmark our website and support our magazine: Never miss the business news you need to know — add Financepost.com to your bookmarks and sign up for our newsletters here.

Article Content

„Oddany rozwiązywacz problemów. Przyjazny hipsterom praktykant bekonu. Miłośnik kawy. Nieuleczalny introwertyk. Student.